Bank's AI Risk Mitigator Agent

Building an AI Bank Risk Mitigator

Here, I focus on the specific context of building a Bank's AI Risk Mitigator that shows better interactive and generative information for better decisions and augments current static risk mitators.

AI or Generative AI can dramatically boost current risk mitigators' capabilities, especially by providing a full view of clients' interactive generative AI information, leading to better investment decisions and opportunities. After all, the best investment decisions are based on the information and data that is available in their hands.

Goals

- Boost current investment decision-making capabilities in the context of information

- Build Information capabilities with interactive and generation AI for better quality information and quality decisions

Context

- Build a real-time banking application with interactive and generation AI information capabilities

- Capture events and extract event-type information from news data in real-time and then alert the application users and apply sentiment analysis for negative or positive event triggers

- Risk mitigation factors are many for Banks so I will only focus on Market or Company Events from the daily news in this post

- Events: Revenue decline, Management change, Share price deviation, Change in Credit rating, etc.

AI Bank Risk Mitigator Solution

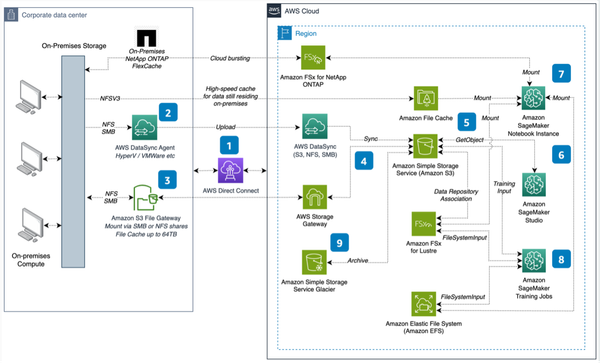

- Data: Subscribe to real-time news data for parsing and training

- Data: Subscribe to Companies and Management data such as S&P Global data sets for parsing and training

- Data: Pick relevant internal databases for parsing and training

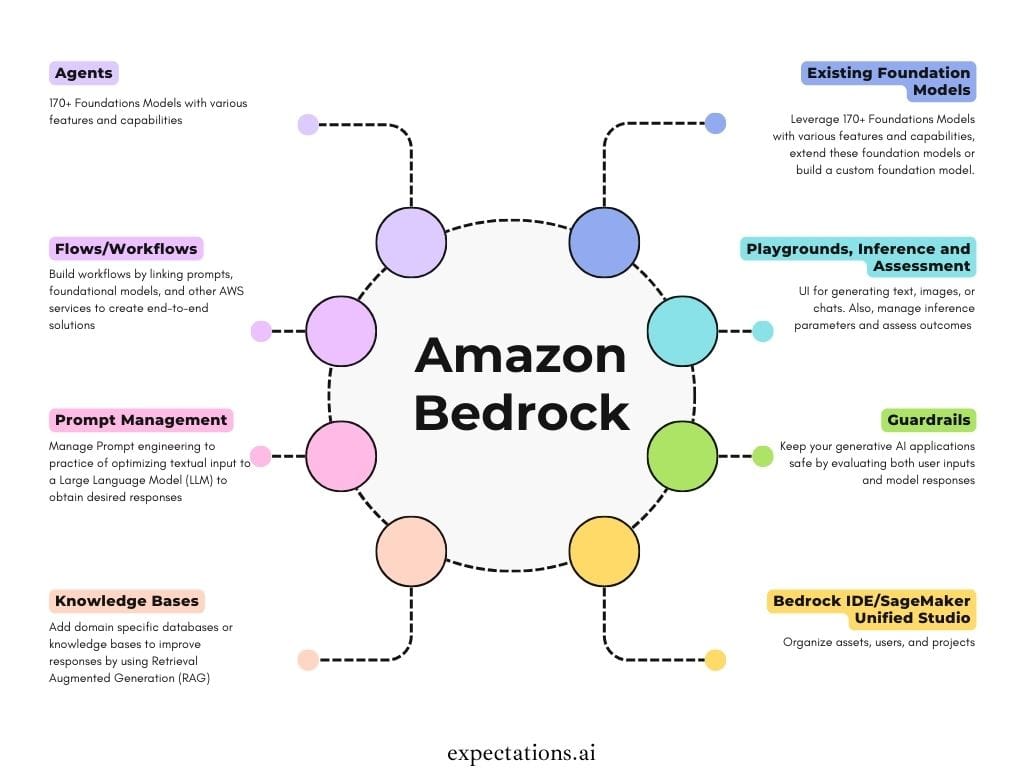

- Base AI Model: Select base Gen AI Models such as Claude or GPTs to augment custom domain-specific AI models as mentioned below

- Custom Bank's specific Natural Language Understanding (NLU) Model: NLU Models such as AWS Comprehend, Azure AI-Language or IBM Watson Discovery/NLU or Cloud domain-specific NLP APIs

- Select a cloud provider: AWS, Azure, Google Cloud or IBM. Note that these cloud providers have many foundation models (LLMs) that you can deploy quickly and train them

- Train the above three data sets with a Custom AI Model

- Application layer: Build a custom application on top of the above base AI model and custom AI model

- Main UI: A Dashboard, Q&A interface Chat UI plug-in, Notifications/Alerts, and Profile Settings. This UI functionality revolves around Risk Events such as Revenue decline, Management change, Share price deviation, Change in Credit rating, etc.

- Q&A Chat UI: Leverage cloud solutions such as Amazon-Q or Amazon-Lex to build quick Chat UI and test backend

- Result: Get real-time notifications on Events (Revenue decline, Management change, Share price deviation, Change in Credit rating, etc), Leverage Generative UI for interactive information on each client, Manage Client info in the Dashboard, and make the right decisions.

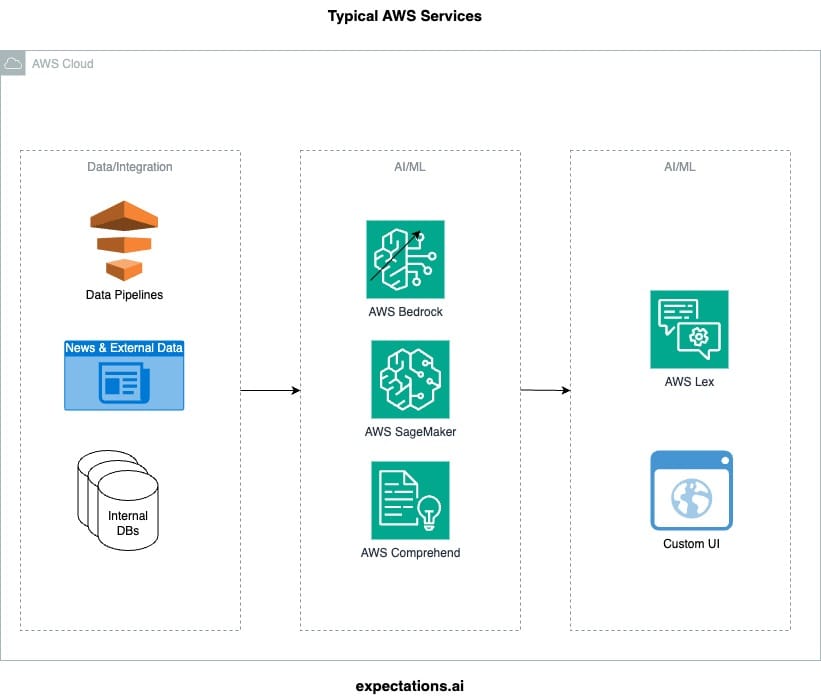

See the typical AWS Services if you pick AWS. You can replicate the same in any other Cloud provider.

Note: Cloud providers offer vast AI/ML services including data integration, storage, high-computing GPUs, 100s of AI Models. These services have to be architected property and create the right solution.

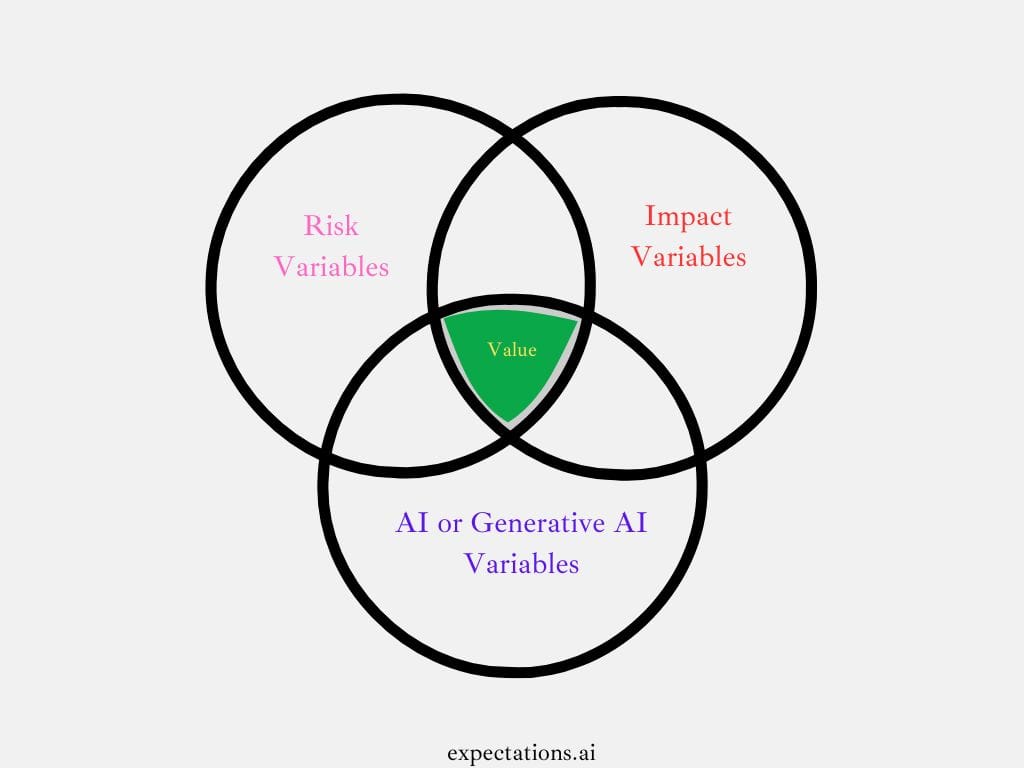

Risk vs Impact vs Value with Generative AI

With Generative AI Foundation Models (LLMs) adoption, Banks can create value and keep adding value at most banks' application levels.

Risk Variables: Revenue decline, Management change, Share price deviation, Change in Credit rating, etc

Impact Variables: Revenue generation, customer retention, Less Risk, etc

Generative AI Variables: Productivity boost, Better Decisions, etc

Conclusion

Banks can leverage Generative AI technologies and create value in their applications in terms of employee-centric AI Agents and Customer-centric AI Agents. The above example is just one example out of many opportunities. Think of AI Virtual Agents at every application and function level.

More Deep Dives